. > TOP STORIES

China prepares to introduce deposit insurance system

Author : Tian Junrong Source : 2014-12-22

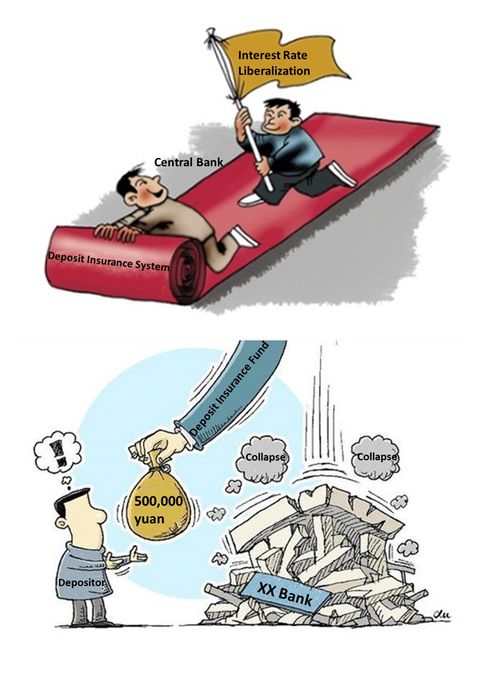

China is advancing the deposit insurance system to safeguard depositors’ savings and pay the way for liberalizing interest rates. File

China could introduce its long-awaited deposit insurance scheme as soon as early 2015 to safeguard savings and free up interest rates. On November 30, the Legislative Affairs Office of the State Council published draft regulations containing 23 articles on its website. It will solicit public opinions on the regulations until December 30, 2014.

Concept of deposit insurance

Deposit insurance is available in many countries to protect bank depositors, in full or in part, from losses caused by a bank’s inability to pay its debts.

The deposit insurance system emerged in the US during the Great Depression period. More than 9,000 banks were successively closed between 1929 and 1933, sparking widespread panic among depositors. To restore consumer confidence, the US government passed the Glass-Steagall Act (1932) and established a national deposit insurance scheme, the Federal Insurance Corporation, to protect the interests of 97 percent of depositors and maintain the financial system’s stability.

Today, more than 110 countries and regions have deposit insurance systems. South Africa, Saudi Arabia and China are the only G20 member countries yet to introduce the system.

The Chinese government has long shown intent to introduce a deposit insurance system. The State Council proposed the idea in a 1993 financial reform decision, noting it was in the public interest. More than 20 years later, the system is nearly ready to be launched.

Profound financial reform

According to the draft regulations, China’s deposit insurance system is expected to use practices common in other nations, such as differential insurance premium rates for financial institutions including commercial banks and rural credit cooperatives. This means that high-risk financial institutions need to pay more, while low-risk ones pay less. The system will also have the fundamental functions of premium accumulation, deposit compensation, information checking, risk warning and disposal.

Setting differential insurance premium rates will largely restrict blind expansion and nonstandard management of financial institutions. Meanwhile, the deposit insurance system has the capability to identify risks in early stages and trigger necessary corrections. All of these factors are conducive to better preventing financial risks.

“Depositors are more willing to put money in big banks with strong anti-risk mechanisms if there is no deposit insurance system. However, depositors have more options in banking with lenders of various sizes if there is a deposit insurance system,” said Wei Jianing, vice director-general of the Department of Macroeconomic Research under the Development Research Center of the State Council.

Introducing the system will level the playing field for banks, Wei noted. “Under a deposit insurance system, more than 7,000 banks have been set up in the US. This has strengthened fair competition and ensured diversity within the financial system,” said Wei.

The deposit insurance system also provides institutional support for interest rate liberalization. Liberalizing deposit rates will narrow the gap between deposit and loan interest rates, largely impacting banks’ long-term profits. For example, the quantity of banks in the US decreased nearly by 50 percent due to interest rate liberalization. The overall situation improved after the deposit insurance system was introduced, however, by making banks more healthy and stable.

Some experts claimed that a deposit insurance system is conducive to perfecting the exit mechanism of financial institutions and creating a strong financial safety net, guaranteeing benign competition in China’s financial industry and enhancing the capacity of finance servicing the real economy.

Powerful protection

Some Chinese depositors have voiced suspicion in a domestic deposit insurance system, especially over the maximum amount of compensation. Under the draft regulations, maximum compensation is likely to be capped at 500,000 yuan ($81,271) per depositor when a bank suffers an insolvency crisis or collapse.

Compared to other countries, China’s maximum compensation looms quite high. It will gradually be revised based on economic conditions, deposit structures and financial risks.

A 2013 survey by the central bank found 99.63 percent of all depositors had less than 500,000 yuan in individual savings accounts. In other words, the proposed coverage ceiling would fully protect the interests of 99.63 percent depositors.

For the 0.37 percent of depositors with more than 500,000 yuan in their savings accounts, they are capable of managing financial risks. “Such wealthy people are usually familiar with financial policies and maintain close relations with banks,” said Zong Liang, deputy director of the Institute of International Finance at the Bank of China.

In addition, some enterprises have questioned whether banks are transferring their burden to depositors or small enterprises. The answer is absolutely no.

There are many financial institutions in China. Fierce market competition restricts the likelihood of banks passing increased costs on to customers, who can choose the bank most suited to their needs.

Banks’ service quality is also expected to improve after the introduction of the deposit insurance system, which will enhance their business operation

The Chinese link: http://finance.people.com.cn/money/n/2014/1130/c42877-26121203.html

Translated by Chen Meina

Revised by Tom Fearon

Ye Shengtao made Chinese fairy tales from a wilderness

Ye Shengtao (1894–1988) created the first collection of fairy tales in the history of Chinese children’s literature...

-

How northern ethnicities integrated into Chinese nation

2023-09-18

-

Mogao caves

2023-09-12

-

Mogao Grottoes as ‘a place of pilgrimage’

2023-09-12

-

Time-honored architectural traditions in China

2023-08-29

-

Disentangling the civilizational evolution of China

2023-08-28

-

AI ethics in science fiction

2023-08-23

2011-2013 by www.cssn.cn. All Rights Reserved

2011-2013 by www.cssn.cn. All Rights Reserved